eBook

Lease Accounting Adoption - Market Snapshot

At the recent EZLease GASB 87 and ASC 842 Virtual Summits, we asked the participants about their lease portfolios, compliance challenges and plans for achieving compliance with the standards. We also heard from them on their resources, closing concerns and key stakeholders. The results show that most organizations have work to do to meet the deadlines, so you’re not alone if you haven’t started.

Download eBook

See how your organization compares to the respondents in terms of:

- Compliance challenges

- Resources

- Implementation

- Project timelines

- Key stakeholders

Now that the delays in the FASB and GASB lease accounting compliance deadlines have passed, it’s time to get started. As you build out your plans for adoption, here is some new data on where your peers stand on implementation.

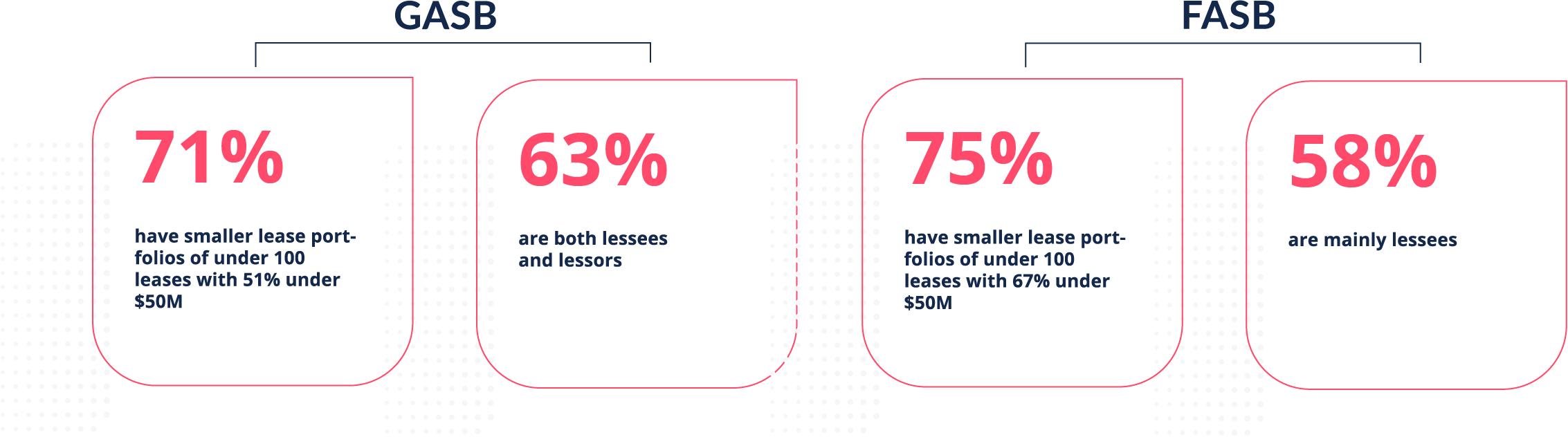

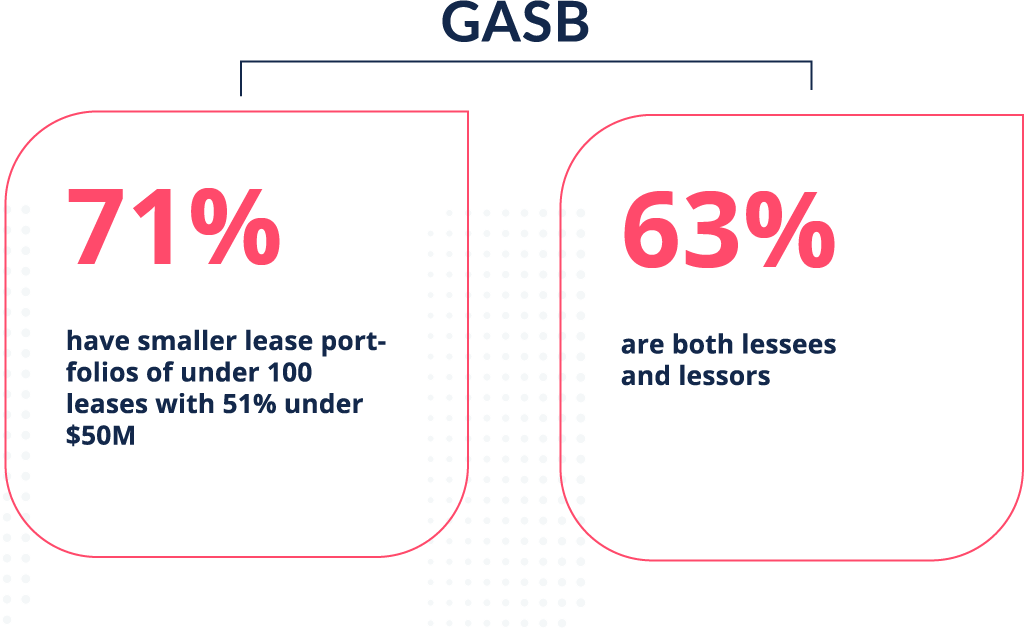

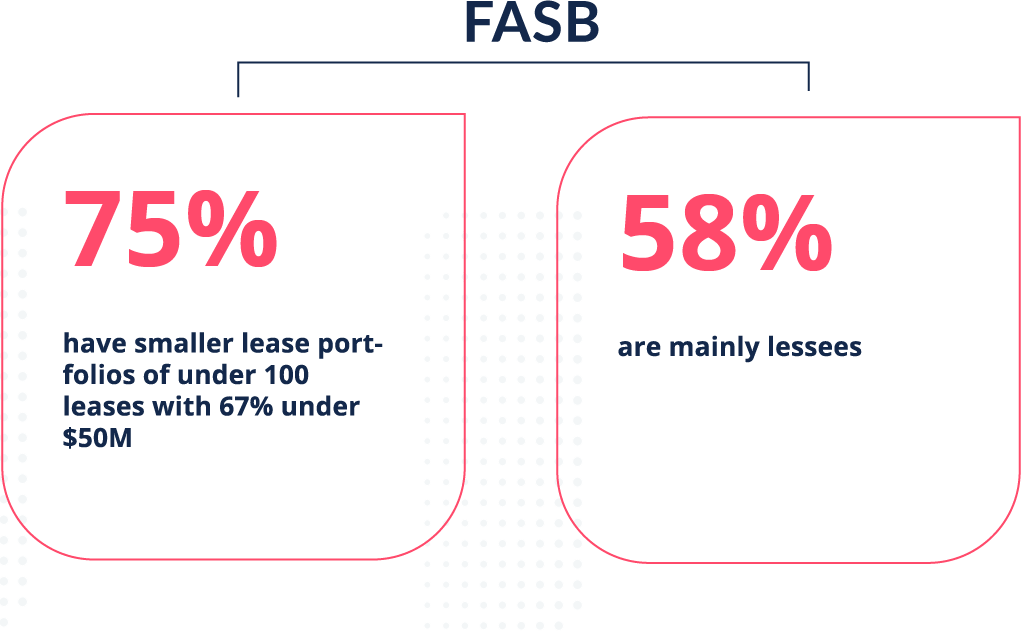

Background on the respondents

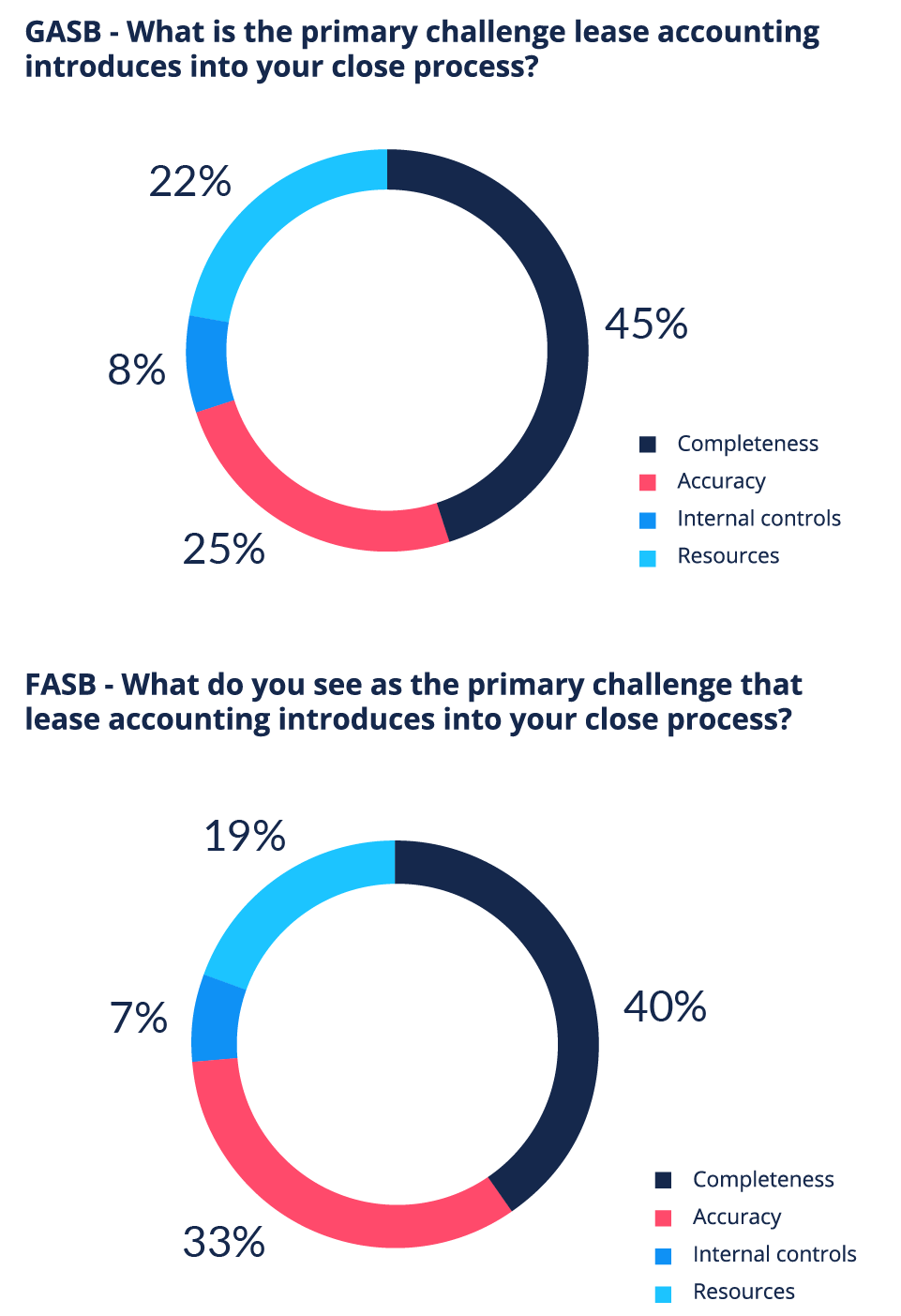

According to the participants, the main challenges that lease accounting introduces into the close process are completeness and accuracy, with the GASB 87 audience slightly more concerned about completeness than the ASC 842 audience. These concerns make sense, given how distributed leases usually are across an organization. And, with the delays in the GASB 87 deadlines, many of those organizations haven’t started the work to track down their leases, so they don’t know how complete their information is. Concern about resources is a close third in closing process challenges – most accounting teams are already busy and complying with the lease accounting standards is generally incremental work. In addition, their existing resources may not have the skills needed to get compliant.